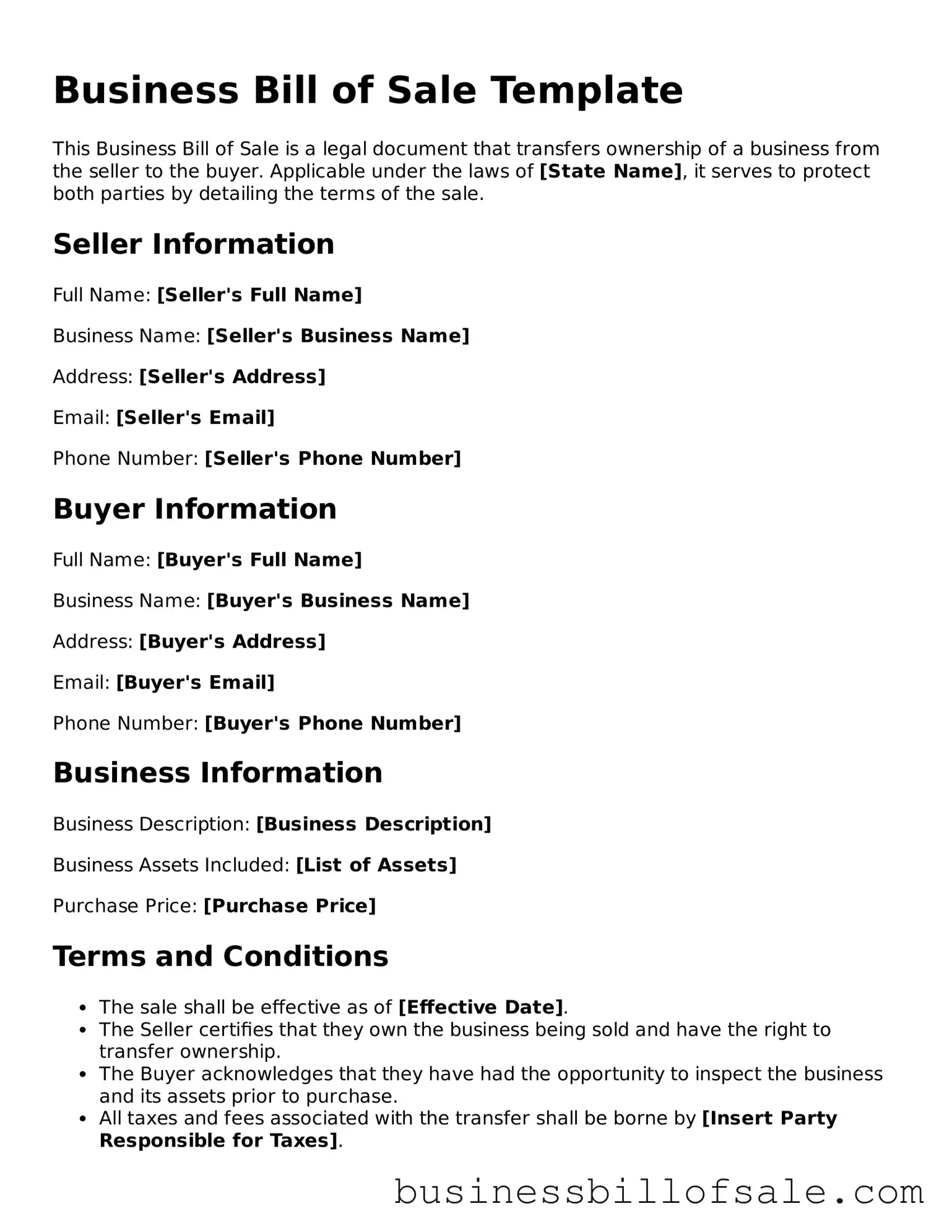

Business Bill of Sale Template

This Business Bill of Sale is a legal document that transfers ownership of a business from the seller to the buyer. Applicable under the laws of [State Name], it serves to protect both parties by detailing the terms of the sale.

Seller Information

Full Name: [Seller's Full Name]

Business Name: [Seller's Business Name]

Address: [Seller's Address]

Email: [Seller's Email]

Phone Number: [Seller's Phone Number]

Buyer Information

Full Name: [Buyer's Full Name]

Business Name: [Buyer's Business Name]

Address: [Buyer's Address]

Email: [Buyer's Email]

Phone Number: [Buyer's Phone Number]

Business Information

Business Description: [Business Description]

Business Assets Included: [List of Assets]

Purchase Price: [Purchase Price]

Terms and Conditions

- The sale shall be effective as of [Effective Date].

- The Seller certifies that they own the business being sold and have the right to transfer ownership.

- The Buyer acknowledges that they have had the opportunity to inspect the business and its assets prior to purchase.

- All taxes and fees associated with the transfer shall be borne by [Insert Party Responsible for Taxes].

Signatures

By signing below, the Seller and Buyer agree to the terms of this Business Bill of Sale.

Seller's Signature: _______________________ Date: _______________

Buyer's Signature: _______________________ Date: _______________

This document may be governed by applicable laws in [State Name]. It is recommended that both parties consult with legal counsel before signing.